The State of Self-Driving Trucks

A few years ago, most media headlines said that robots would rule the roads. It was not a matter of if but when. And that time was imminent.

But the media hype has since cooled, and OEMs have pushed out production timelines. Yet a handful of companies in the autonomous truck sector are quietly moving the industry toward a self-driving reality in the next three years.

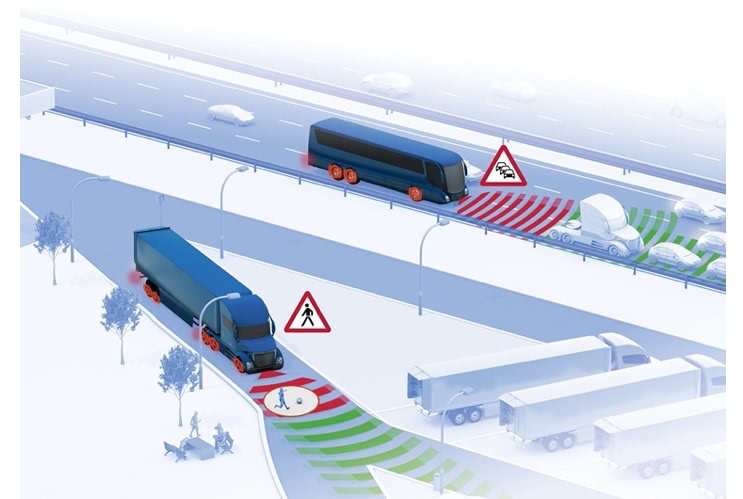

Understanding these advancements is crucial for utility fleets – not just for staying ahead of potential regulatory shifts but also for anticipating how these technologies might eventually trickle down to vocational vehicles.

So, what are the latest developments in self-driving trucks? Here are six to keep your eye on.

Aurora Innovation

Raised $483 million, announced partnership with Uber Freight

Self-driving technology company Aurora Innovation has raised $483 million in a new stock sale, exceeding its $420 million target. The funds give Aurora financial runway into 2026, past its initial driverless deployment. The Pittsburgh-based firm is prioritizing the commercialization of autonomous trucks.

Aurora attributes its fundraising success to its Aurora Driver technology, which it claims is the industry’s most advanced driverless system. The company is hauling freight for pilot customers like FedEx and Schneider, completing nearly 7,000 loads over 1.8 million miles. Aurora has partnerships with truck manufacturers Volvo and Peterbilt and a deal with Continental to manufacture its self-driving system at scale by 2027.

The company plans to launch driverless trucks in Texas by the end of this year, announcing a long-term agreement with Uber Freight to deploy autonomous trucks between Dallas and Houston, with plans to expand the program in the coming years.

The program will initially involve human drivers for parts of the journey, particularly in areas with tighter lanes and turns.

Waabi Innovation

Raised $200 million to launch Level 4 driverless trucks in 2025

Canadian autonomous truck startup Waabi Innovation Inc. secured $200 million in new funding to develop and deploy fully driverless, AI-powered trucks by 2025.

The company claims its Waabi Driver technology uses generative AI capable of humanlike reasoning, enabling it to respond to any situation that might happen on the road, including those it has never seen before. Because it can “reason,” the system requires significantly less training data and computational resources than competing systems, the company said.

The technology is paired with an advanced simulator called Waabi World, reducing the need for extensive on-road testing while aiming for Level 4 autonomy, which allows vehicle operation without human intervention in most conditions.

The Series B funding round was led by Uber Technologies Inc. and Khosla Ventures LLC, with participation from notable investors, including Nvidia Corp., Volvo Group Venture Capital AB and Porsche Automobil Holding SE.

Kodiak Robotics

Collaboration with J.B. Hunt and Bridgestone for autonomous long-haul transport

A collaboration between J.B. Hunt Transport Services Inc., Bridgestone Americas Inc. and Kodiak Robotics Inc. has completed over 50,000 miles of autonomous long-haul trucking. The partnership, launched in January, operates a route transporting Bridgestone tires between South Carolina and Dallas, with the 750-mile stretch from Atlanta to Dallas completed using Kodiak’s autonomous driving technology.

The autonomous route has maintained a perfect safety record and 100% on-time performance, leading to an expansion of weekly deliveries. J.B. Hunt handles transportation to and from Bridgestone facilities and Kodiak hubs, while also using its 360box network to secure return trip capacity from Dallas.

The operation involves a multistep process: J.B. Hunt moves loads from Bridgestone’s South Carolina plant to Kodiak’s Georgia hub; Kodiak’s autonomous trucks complete the long-haul portion to Texas under safety driver supervision; and J.B. Hunt delivers the final stretch to Bridgestone’s distribution center.

Plus

Pilot program with Navistar to launch late 2024

Navistar has partnered with autonomous driving technology developer Plus to create hub-to-hub self-driving Class 8 trucks. The companies are currently testing autonomous International LT Series tractors equipped with Plus SuperDrive technology on public roads in Texas, with plans to launch a commercial pilot program with fleet customers by the end of 2024.

While the test vehicles still have safety drivers, the goal is to develop fully autonomous trucks for long-haul routes between designated freight hubs. The companies expect to commercially launch fully autonomous trucks late this decade, emphasizing that the rollout will be gradual.

Gatik

Self-driving tech for short-haul routes

Autonomous truck startup Gatik is poised to begin mass production of its self-driving vehicles by 2027.

Gatik focuses on short-haul, middle-mile delivery routes and has secured over 300 truck orders for deployment by the end of 2025. Gatik’s business model involves five-year customer contracts without termination clauses, ensuring steady revenue even if trucks are idle.

The company’s autonomous trucks feature redundant systems for driverless operations, which have already begun for some customers like Walmart and Loblaw. Gatik expects to expand driverless deliveries to more clients, including Tyson Foods and Kroger, by late 2024 or early 2025.

Daimler Truck

Targeting 2027 for autonomous truck launch

Daimler has unveiled its first autonomous truck demonstrator, aiming to launch fully driverless freight hauling by 2027.

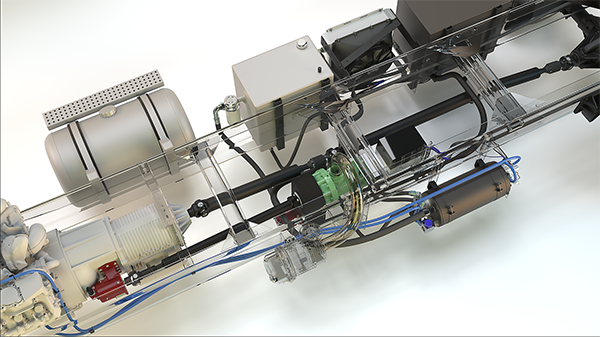

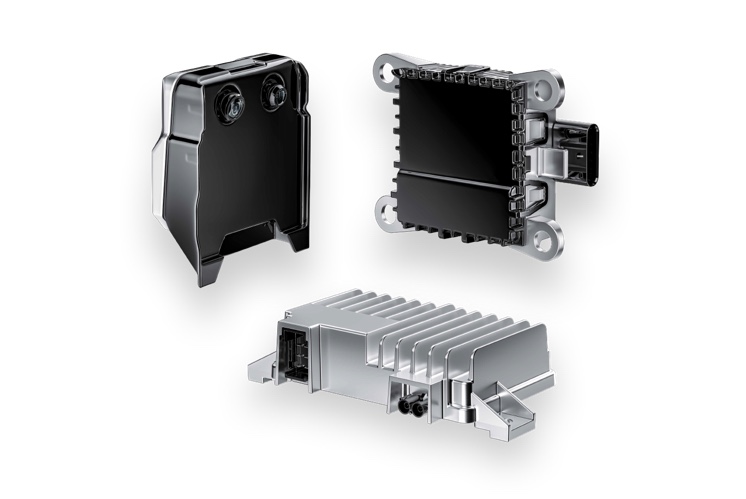

The company is collaborating with Waymo and its own subsidiary, Torc, on autonomous systems. The truck features an array of sensors, including lidar from Aeva Technologies and multiple radars for comprehensive environmental perception.

While the demonstrator is an all-electric Freightliner eCascadia, Daimler is developing its self-driving system to be compatible with various powertrains, including hydrogen fuel cells. The company is particularly interested in exploring the interaction between electric propulsion and autonomous driving systems, as driverless technology can be power-intensive and may affect range and towing capacity.

Daimler plans to retain safety drivers during testing and for complex scenarios but envisions future designs that may eliminate traditional controls like steering wheels.

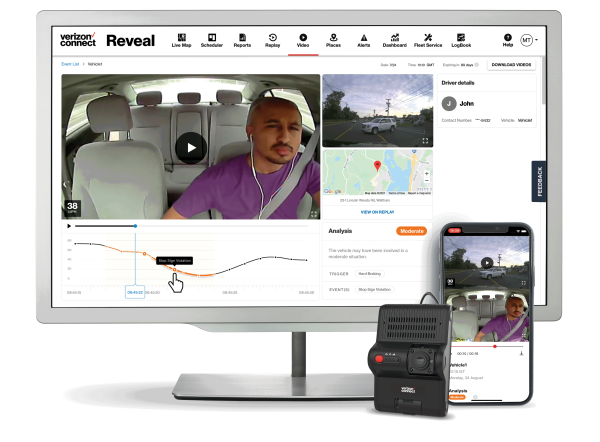

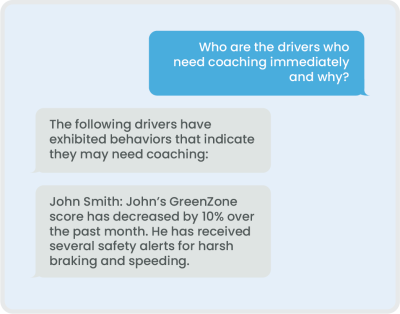

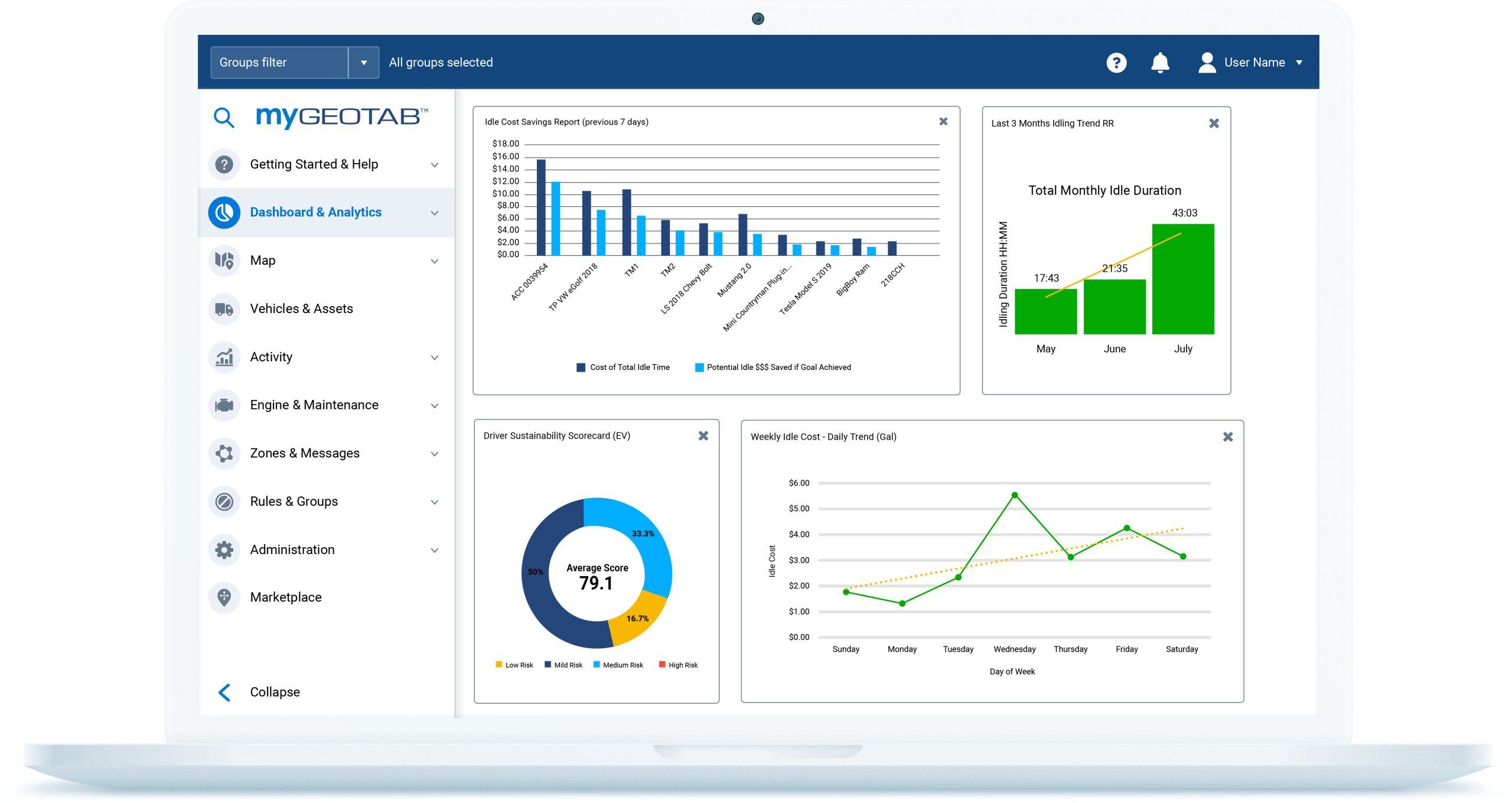

Artificial intelligence is reshaping fleet management – whether you notice it or not – to improve operations, enhance safety and reduce costs.

Artificial intelligence is reshaping fleet management – whether you notice it or not – to improve operations, enhance safety and reduce costs.

How can you expand your influence with your boss and direct reports?

How can you expand your influence with your boss and direct reports?